RFM Segments

Find out who are your best customers — whom you want to treasure and keep satisfied and who's on the other side of the spectrum — needing encouragement to keep them from cutting and running to your competitors. CDP & CRM Carecloud will group your customers into segments according to their RFM parameters — doing all the work for you! Additionally, we also provide you with tips on how to engage with each segment to improve KPIs.

Key terms used in this article: Workflow (see this user guide page for more about workflows) — Segment (see this user guide page for more about segments) — Purchase History - Purchasing Behavior (see this user guide page for more about purchasing behavior).

First, we'll describe what RFM is, what's the metric suitable for, and why you should use it. Then we'll define every segment and include tips on engaging with each of them to give them the attention they need.

Scroll down for the Overview and Transitions sub-pages.

What Is RFM?

RFM is a shortcut for Recency, Frequency, and Monetary parameters.

Recency

Recency corresponds to the last time the customer made a purchase, as it is time that has elapsed since the customer's last transaction. The more recently a customer has interacted, the more likely that customer will be responsive to communications.

Frequency

Frequency measures how many times the customer makes a purchase in a given time period. Customers with frequent activities are more engaged and probably more loyal than customers who rarely do so.

Monetary

Monetary is the total amount spent. Big spenders should be treated differently than customers who spend little.

RFM measures and analyzes spending habits. All you need to work with RFM is the customers' purchasing history — when and for how much they purchased. You can review these data for each particular customer in CareCloud’s 360 Customer View app. The CareCloud database collects purchasing history for the whole customer database, so when using CareCloud, you can utilize RFM data easily.

RFM is popular because it is intuitive and straightforward. You can easily understand and interpret direct and concise data provided in the RFM widgets and dashboards.

Why Use RFM Parameters?

RFM analysis helps you to answer key questions such as. Who are your best customers? Which customers contribute to your churn rate the most? Who is likely to respond to engagement campaigns? Find out the similarities between your customers, what differentiates them from each other, or who has the potential to become a loyal customer? Which important customers are about to leave?

RFM Segments

CareCloud groups customers according to their RFM scores and turns them into customer segments. Target each RFM segment according to its needs to drive its lifetime value up!

What Does the Process Look Like?

CDP & CRM CareCloud assigns each RFM parameter a score on a scale from 1 to 5 (1 being the worst and 5 being the best score).

How Is It Calculated?

The RFM scales are already adjusted for your customer base because CareCloud evaluates percentiles to create an RFM score for each customer. Then CareCloud groups customers into segments based on their assigned scores. The criteria always adjust to your brand and vertical, thanks to using percentile values. Car sales and pharmacy businesses experience uncomparable purchase frequency and amount spent, but thanks to percentiles, the assigned scores create appropriate RFM segments for both businesses.

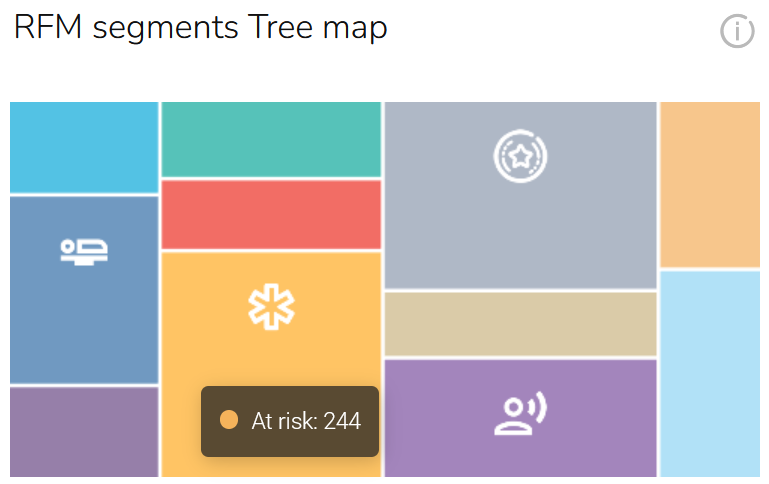

In CDP & CRM CareCloud, you'll find a graph visually expressing the size of each segment.

Descriptions and Tips

In the table below, you will find descriptions of each segment, which RFM scores they belong to, and what the purchasing behavior of each segment looks like. We're also offering tips on engaging with each segment but don't hesitate to develop your own strategies.

| Segment | RFM scores | Purchasing Behavior | Tips |

|---|---|---|---|

| Champions | 555, 554, 544, 545, 454, 455, 445 | Purchase the most recently, shop most often, and spend the most. Their RFM scores are the highest of all segments. | They can become early adopters of new products and will help promote your brand. Make them feel valued, cooperate with them and actively communicate new products or features. Large discounts are not recommended for this segment. |

| Loyal | 543, 444, 435, 355, 354, 345, 344, 335 | Purchased recently, shop regularly and respond to promotions. They differ from Champions by a lower frequency or monetary score. | Offer discounts to gradually increase their amount spent and lead them to be Champions. Follow their buying behavior and offer suitable promotions. |

| Potential Loyalist | 553, 551, 552, 541, 542, 533, 532, 531, 452, 451, 442, 441, 431, 453, 433, 432, 423, 353, 352, 351, 342, 341, 333, 323 | Recent customers who purchased recently or shopped frequently. Have lower monetary value than Loyalists. | Suggest membership /loyalty programs or recommend related products to upsell them and help them become loyalists or champions. Potential loyalists need to feel valued to spend more - actively promote customer benefits and perks. |

| New Customers | 512, 511, 422, 421 412, 411, 311 | These newcomers made their first purchase recently, but their frequency and monetary value are low. | Provide onboarding support, and reach out to them as soon as possible. Start building a relationship, and send special offers to increase their visits. Monitor them constantly to prevent them from dropping out. |

| Promising | 525, 524, 523, 522, 521, 515, 514, 513, 425, 424, 413, 414, 415, 315, 314, 313 | These don’t spend frequently but made large purchases recently. They have great spending potential but have not formed a habit of shopping from your brand. | Provide them with a reason to come back. Target them with purchase follow-ups and encourage repeat purchases of products with regular use. Personalize offers to give them a feeling of understanding their needs. |

| Need Attention | 535, 534, 443, 434, 343, 334, 325, 324 | Core customers with high monetary value and reasonable recency but lower frequency. They need attention to build a relationship with your brand to become Potential Loyalist or Loyal. | Make time-limited offers to increase shopping frequency. Figure out their interest area and personalize promotions to match that area. Nurture them with automated workflows on repeated purchases. |

| About to Sleep | 331, 321, 312, 221, 213, 231, 241, 251 | Customers with low monetary scores and mediocre recency. These customers might soon lose interest in your brand. Without attention eventually degrades to Lost Customers. | Try to improve their frequency by providing discounts and special promotions focused on saving money (e.g., unconditioned free delivery). Promote to them the most popular products and budget-friendly products. |

| Cannot Lose Them | 155, 154, 144, 214, 215, 115, 114, 113 | Customers with large monetary value who were key spenders. They haven't shopped for a while, and their frequency might be dropping as well. | Find out what went wrong and what they need by collecting feedback. Create personalized communications and try to address issues from feedback to increase loyalty. Provide value-increasing promotions such as 1+1 free. |

| At Risk | 255, 254, 245, 244, 253, 252, 243, 242, 235, 234, 225, 224, 153, 152, 145, 143, 142, 135, 134, 133, 125, 124 | Customers with reasonable monetary and frequency scores, but with long time since last purchase. At the immediate risk of losing the relationship with your brand. | Provide a strong incentive to return. Give significant discounts and target historically purchased products or the most trending ones. Communicate intensively to build momentum and prevent losing them. |

| Hibernating Customers | 332, 322, 233, 232, 223, 222, 132, 123, 122, 212, 211 | Customers with low monetary and frequency values who have not purchased for some time. | Provide time-limited promotions and alternate between discounts and value-increasing promotions to hit the right incentive. Aim at regular and most purchased products from your portfolio. |

| Lost Customers | 111, 112, 121, 131, 141, 151 | They made the last purchase a long time ago, and the monetary score is the lowest. Lost interest in your brand. | Try reviving reach-out campaigns or automation from time to time. Promote top hits from your product portfolio and aim for small purchases to revive the relationships. |